Things did not pan out as many were expecting post the quadrennial Bitcoin Halving. Let’s dive into what we know so far.

The weighted average funding rate for Bitcoin continues to dip negative as BTC chops around the $62K – $65K mark. For now the market appears to be somewhat unsure of the next breakout direction. Negative funding rates typically occur when the price of Bitcoin perpetual futures contracts are lower than the price of the underlying asset. This change suggests a cooling interest in leveraged bullish bets on Bitcoin – which coincides with the fading impact of major market drivers. What is certain; macro conditions of late are leading to increased risk aversion among investors and this is seen in the recent funding rate reversal below zero. The move underscores an uneasiness among traders to take long positions.

Despite the anticipation surrounding the Bitcoin Halving event reducing the Bitcoin block reward and theoretically shrinking the supply of new coins – the price impact has been surprisingly muted. The highly anticipated quadrennial Halving event is a pre-programmed mechanism which automatically reduces the amount of Bitcoin awarded to miners by 50% roughly every four years and will continue to do so until all 21 million Bitcoins are mined – with an estimated completion date in 2140. Unlike traditional currencies controlled by governments – Bitcoin has a fixed total supply. Halving the block reward over time slows down the rate at which new Bitcoins enter circulation.

This mechanism was put in place to counteract inflationary pressures and thereby ensure Bitcoin did not succumb to the slow erosion of purchasing power – a design flaw inherent in government issued currencies. With fewer new Bitcoins entering the system, each existing Bitcoin has the potential to become more valuable – therefore preserving one’s wealth over time. This fourth halving marks a major turning point for Bitcoin – with its issuance rate (0.83%) finally dipping below that of Gold’s (2.3%), making it the scarcest asset globally!

It is important to remember that issuance is a fraction of the on-chain transfer, spot and derivatives volume we see today, and is currently equivalent to less than 0.1% of the aggregate capital moved and traded on any given day. As Bitcoin continues to change hands at an even faster rate – the impact that Bitcoin Halvings have on the available traded supply is diminishing across cycles. This may explain the muted price action post this 2024 Halving. One thing is for sure – this Halving reflects the complexities of predicting Bitcoin’s market dynamics solely based on historical Halving outcomes.

Here’s a timeline of past Halvings and their impact on block rewards:

November 2012: Block reward went from 50 BTC to 25 BTC.

July 2016: Block reward went from 25 BTC to 12.5 BTC.

May 2020: Block reward went from 12.5 BTC to 6.25 BTC.

April 2024: Block reward went from 6.25 BTC to 3.125 BTC (This just happened!).

Source: Glassnode

What can we expect in this post-halving environment?

Although the resulting reduction in Bitcoin issuance should (in theory) be a positive catalyst for BTC’s price. Miners on the other hand will have to keep running with the same operational costs and less revenue. This is because the block reward Bitcoin miners receive for validating transactions are slashed in half. Inefficient or poorly capitalised mining operations will struggle in the wake of the Halving, and their rivals may take advantage of the situation to buy distressed assets.

There is, however, a silver lining for established miners. This year’s Halving coincides with the long-awaited arrival of US-approved Bitcoin Exchange Traded Funds (ETFs). These investment vehicles have opened the floodgates for institutional money to pour into Bitcoin, driving its price upwards. This price surge has cushioned the blow of the Halving effect on miners – many of which sold their Bitcoin (BTC) reserves ahead of the event. In the past miners have exerted significant selling pressure pre-halving so as to maximise earnings before their revenues are slashed post-halving – this time was no different.

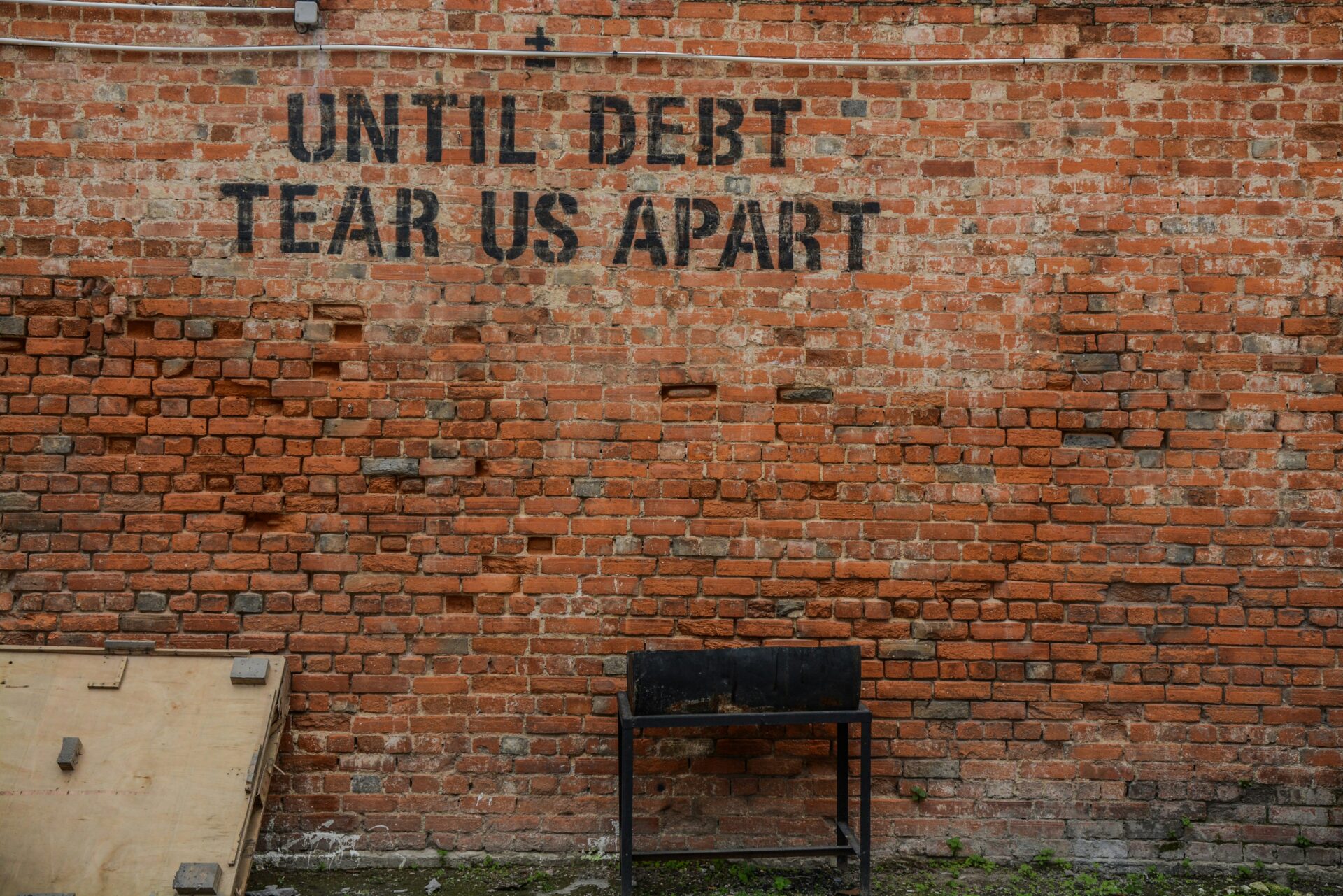

We may be witnessing a perfect storm for a move into fresh all-time highs. With geopolitical tensions fuelling a flight to safety, an inherent supply squeeze through the Halving, a simultaneous surge in institutional adoption in a post-ETF environment as well rising government debt concerns which may force the US Federal Reserve to cut interest rates sooner than later.

What is more; ETF demand has, on average, outstripped Bitcoin supply by over 150,000 BTC in this post-halving environment. Since their January debut – US spot Bitcoin ETFs have maintained a total net inflow of $12.42 billion – with total net assets of $55.82 billion.

With the East now joining the fold – ETF demand is primed to increase even further. The Hong Kong Securities and Futures Commission (SFC) recently approved several fund managers to offer spot Bitcoin ETFs – many of which are poised to go live as soon as next month. Singapore-based Matrixport expects mainland Chinese investors to pour up to $25 billion into Hong Kong’s Bitcoin ETFs!

While wealth preservation is a significant driver behind Bitcoin’s price, its utility as a tool for wealth transfer is beginning to gain traction – especially in Africa. The International Monetary Fund, in a recent study, acknowledged Bitcoin’s increasing role in facilitating cross-border financial flows, particularly in regions with capital controls or limited access to traditional financial systems. This highlights Bitcoin’s unique potential to empower individuals and businesses to navigate financial restrictions. Helping African businesses find better alternatives to sending value is one of the core reasons behind OVEX‘s existence in the first place!

It is crucial to remember that the cryptocurrency market remains volatile, and external factors can significantly impact its price. Nevertheless, the recent developments suggest a maturing Bitcoin ecosystem with growing mainstream acceptance and potential for broader real-world applications.