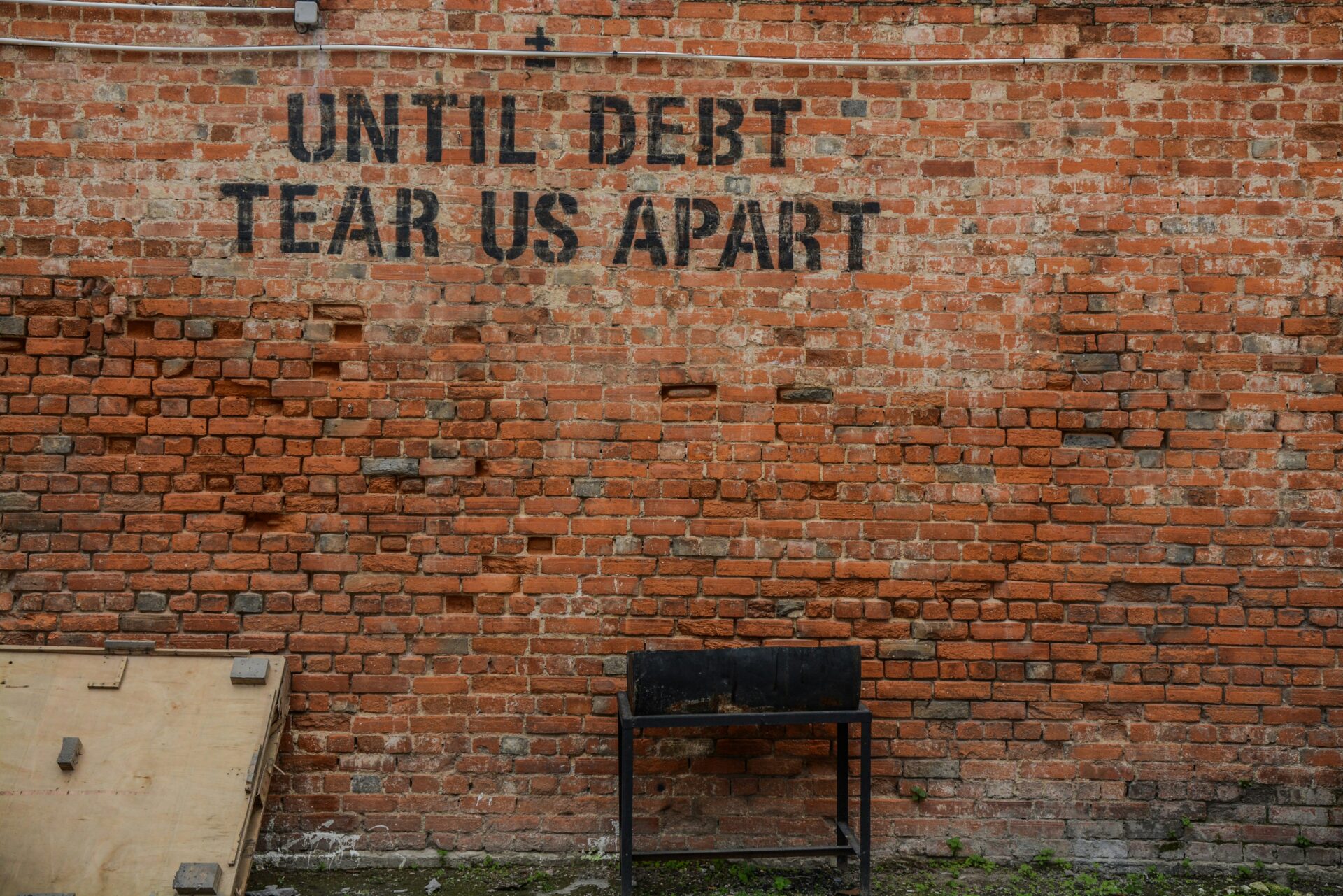

America’s mounting debt is casting long shadows over its economic future. Both major presidential candidates have added trillions to the national deficit, with fiscal discipline often taking a back seat to political expediency. This year alone, the U.S. will spend $892 billion on interest payments—exceeding defense spending—and this figure is projected to surpass $1 trillion by 2025, nearly equaling the total budget for Medicare.

The consequences of these soaring deficits are profound. Higher debt levels exacerbate inflation, complicating the Federal Reserve’s efforts to maintain price stability. Credit rating agencies have already taken notice, with Moody’s lowering the U.S. credit outlook and Fitch downgrading America’s credit rating following last summer’s debt ceiling crisis. The U.S. is now under scrutiny, with government bond yields setting benchmarks for other types of debt, which could hinder economic growth if they remain elevated.

The global context adds to the urgency. Other developed nations, including Japan, France, Canada, and the U.K., face similar debt-to-GDP challenges. “Markets could at some point question fiscal sustainability,” warned Claudio Borio, head of the economic department at the Bank for International Settlements. History has shown that fiscal stability can suddenly unravel, leading to a crisis.

A potential crisis could manifest through a failed Treasury auction, forcing drastic budget cuts. Such an event would likely trigger an economic contraction and a significant loss of confidence in the dollar, jeopardizing growth prospects. Entitlement programs are a major driver of debt, yet meaningful reform remains politically elusive.

In this precarious environment, both bitcoin and gold have seen increased demand as safe-haven assets, with bitcoin rallying 48% and gold 13% this year. While bitcoin advocates view it as a hedge against fiat currency instability, the cryptocurrency has not been immune to broader market stresses.

The pandemic’s economic fallout, coupled with rapid rate hikes by central banks, has pushed the U.S. debt-to-GDP ratio to 123% by the end of 2023. This backdrop fuels speculation that mounting debt concerns will force the Federal Reserve to cut rates, potentially boosting alternative assets like bitcoin. According to the CME FedWatch Tool, market participants are currently pricing in a 66% chance of a September rate cut.

America’s debt dilemma is a high-stakes balancing act with significant implications. As traditional fiscal measures falter, the allure of alternative assets like bitcoin could grow, reflecting deeper concerns about economic stability and confidence in fiat currencies.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).