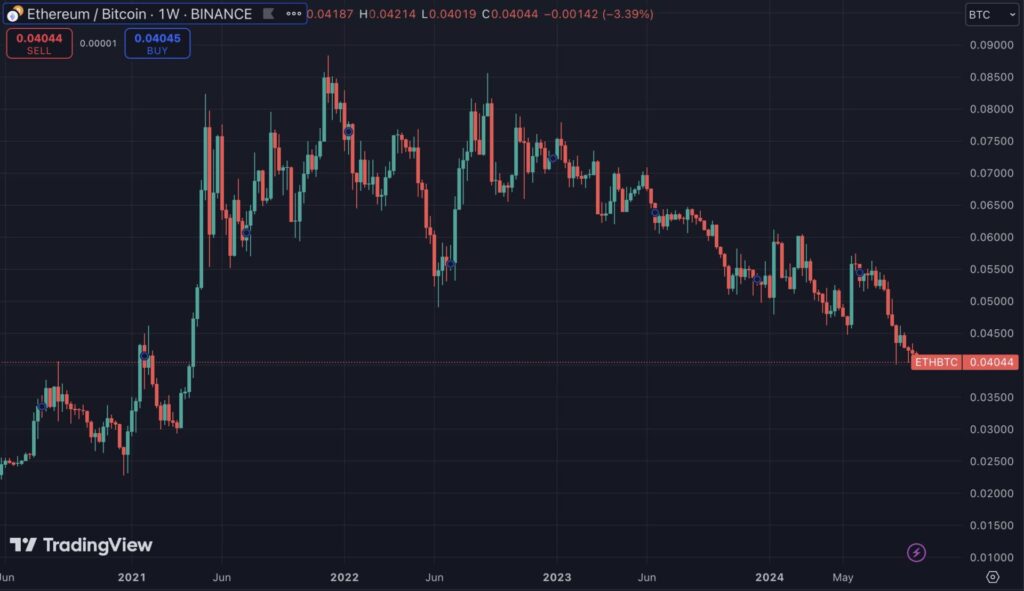

Ethereum has underperformed against Bitcoin by 44% since the much-anticipated Merge – which ushered in the cryptocurrency’s transition from a Proof-of-Work to a Proof-of-Stake blockchain. This underperformance can be visualised in the chart below. You can also look at the current ETH/BTC price and trade the two against each-other using the OVEX Instant Buy/Sell trading tool.

There are several factors at play here: (1) Ethereum issuance outpacing that of Bitcoin, (2) Institutional interest in Bitcoin trumps that of Ethereum, (3) Ethereum on-chain metrics are sluggish, (4) Bitcoin’s market dominance continues to outpace the entire crypto-sphere and (5) Macroeconomic pressures.

(1) Bitcoin’s latest halving event, which occurred in early 2024, resulted in coin issuance being slashed in half. This translates into Bitcoin becoming more ‘disinflationary’ over time, with fewer coins entering the market. Bitcoin’s supply mechanism is referred to as ‘inelastic’ as it does not expand or contract with demand. In other words – Bitcoin cannot arbitrarily inflate or deflate supply to accommodate a growing demand. This makes existing Bitcoin more valuable over time (that is if demand persists).

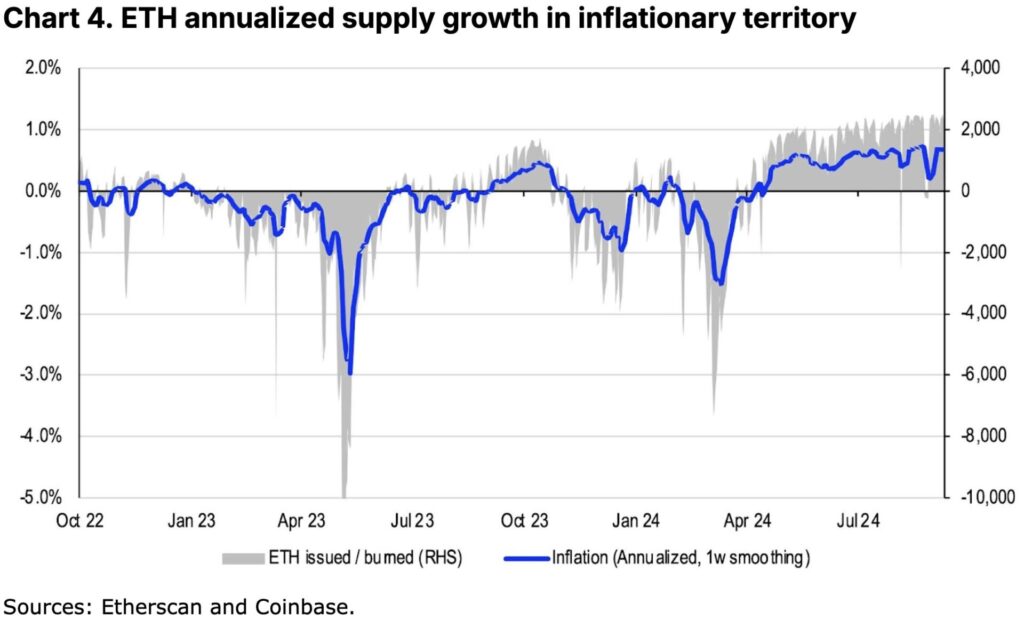

On the other hand, Ethereum’s supply can easily flip from inflationary to deflationary depending on network activity. This is known as a ‘semi-elastic’ supply. When there is a high usage rate, the fee to transact adjusts higher (and a larger portion of these rising transaction fees are burned as a result of EIP-1559). If high usage persists, then fees could rise beyond the issuance rate (as a result of the burn mechanism) – resulting in a deflationary effect. When net issuance is negative on the Ethereum network, Ether may act as a deflationary token. On the flip side – when there is little network activity Ethereum can become inflationary. This can be visualised in the chart below:

(2) The second reason why Ethereum may be underperforming is as a result of Bitcoin dominating institutional interest despite Ethereum Spot ETFs getting the green light from the US Securities Exchange Commission just months ago. In contrast to the influx of capital seen in BTC ETFs – ETH ETFs on the other hand – have experienced net outflows surpassing half a billion dollars since launch and deflating the market’s optimism.

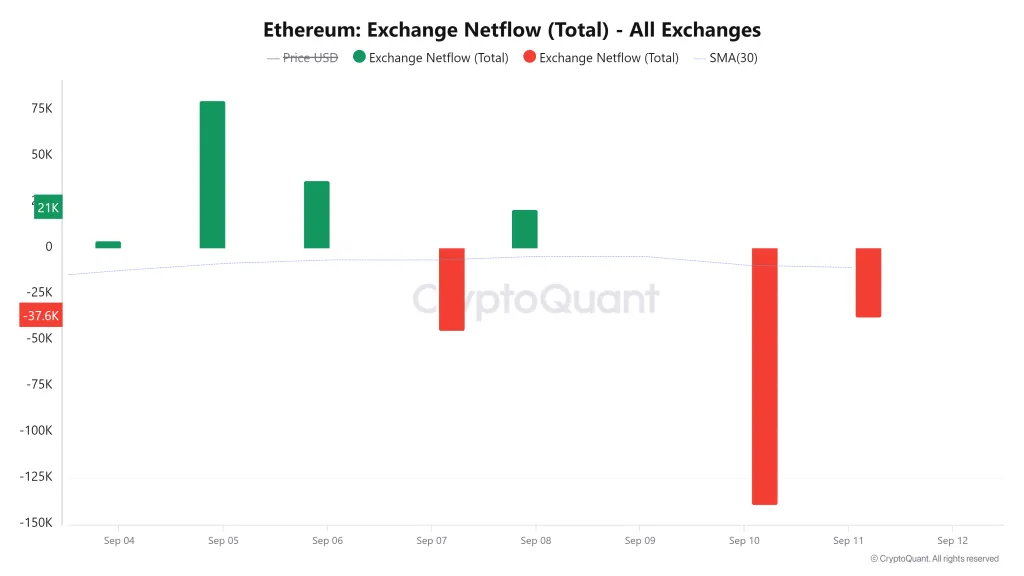

(3) Ethereum on-chain metrics have been persistently sluggish. Ethereum’s total value locked (TVL) has dwindled from $67 billion in June to $44 billion, a worrying trend that underscores the need for a new narrative or innovative development to redefine its market structure. What is more; the most recent 30-day average of 430,250 daily active addresses on the Ethereum network reflects a 7.7% decrease from 90 days prior and is nowhere near the 686,350 seen in May 2021. The reduction in users interacting with the protocol is mirrored in the dwindling transaction count explored in (1) above.

(4) As reported by Cointelegraph, Bitcoin’s market dominance continued its upward trajectory in 2024, reaching a 40 month high of 58% on August 5th. This indicates that the largest cryptocurrency is strengthening against altcoins, including Ether. Bitcoin dominance measures Bitcoin’s market capitalization relative to the overall crypto market and is indicative of the assets’ strength. It is often used by investors to gauge market sentiment.

(5) There are other non-crypto macro related factors at play here too. The reversal of the JPY carry trade in early August was the trigger for mass deleveraging in many asset classes, and ETH may have been the most vulnerable position across the many portfolios that required forced selling.

Ultimately a major narrative change is needed for ETH to overcome these hurdles in the short term. This could involve more experimentation on the mainnet to compete with alternative L1s or the onboarding of more real world assets onto the platform. The Ethereum Foundation is hard at work to achieve this.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).