A Trader’s Guide to Open Interest: What It Is and Why It Matters

If you’ve ever dived into the world of cryptocurrency derivatives, you’ve almost certainly come across the term “Open Interest.” While it might sound complex, it’s a vital metric that, when understood correctly, can offer powerful insights into market trends and sentiment.

This guide breaks down what Open Interest is, how it differs from trading volume, and how you can use it to better understand market dynamics.

What Exactly is Open Interest?

Open Interest (OI) is a metric used in derivatives trading, such as crypto futures and options contracts.

In simple terms, it represents the total number of outstanding or unsettled contracts that exist in the market at a specific time. These are all the active positions that have not yet been closed, offset, or fulfilled by delivery.

For example, every Bitcoin perpetual futures contract that is currently held by a trader—whether long or short—counts toward the total Open Interest for that market.

Open Interest vs. Trading Volume: What’s the Difference?

It’s common for new traders to confuse Open Interest with Trading Volume, but they measure two very different things.

Open Interest is a snapshot of all active contracts. Think of it as the total number of cars on the highway at 5 PM. It tells you the total number of commitments traders have made.

Trading Volume measures activity over a period. It counts the total number of contracts exchanged (both bought and sold) within a given timeframe (e.g., the last 24 hours). Think of it as the total number of cars that entered the highway between 4 PM and 5 PM.

Volume provides information about the liquidity and immediacy of a market, while Open Interest provides information about the total capital and conviction within it.

Why is Open Interest Useful for Traders?

Open Interest is a powerful tool because it helps traders understand the flow of money into or out of a market

Increasing Open Interest: This means more new contracts are being created than are being closed. It suggests that new money is entering the market, which can signal strength and conviction behind the current price trend.

Decreasing Open Interest: This means more contracts are being closed (positions are being settled) than new ones are being opened. This implies that money is leaving the market, which can suggest a prevailing trend is losing momentum.

By looking at the net change in Open Interest, traders can gauge whether new money is flowing in or existing money is flowing out, helping them analyze market trends.

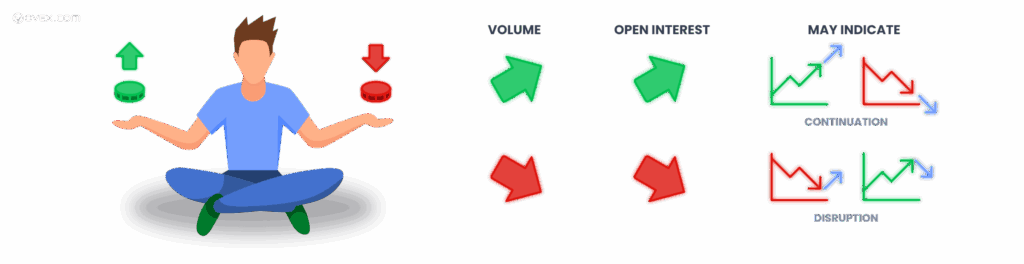

How to Interpret Open Interest and Volume Together

While useful on its own, Open Interest is most insightful when combined with Trading Volume. Here are two general rules to keep in mind:

Increasing Volume + Increasing Open Interest: This combination typically indicates a strong continuation of the current price trend (whether that trend is up or down). New money is actively entering the market, and trading activity is high, confirming the trend’s strength.

Decreasing Volume + Decreasing Open Interest: This pairing often suggests that the current price trend is weakening or nearing an end. It implies that traders are closing their positions, new money isn’t replacing them, and general market activity is dropping off.

Understanding these simple relationships can add a new layer of context to your market analysis.

Disclaimer: Crypto trading carries risk, including loss of capital. Prices are volatile and past performance does not predict future results. This is not financial advice or an invitation to trade. OVEX (Pty) Ltd is an authorised FSP (53922) and NCR credit provider (NCRCP15552).