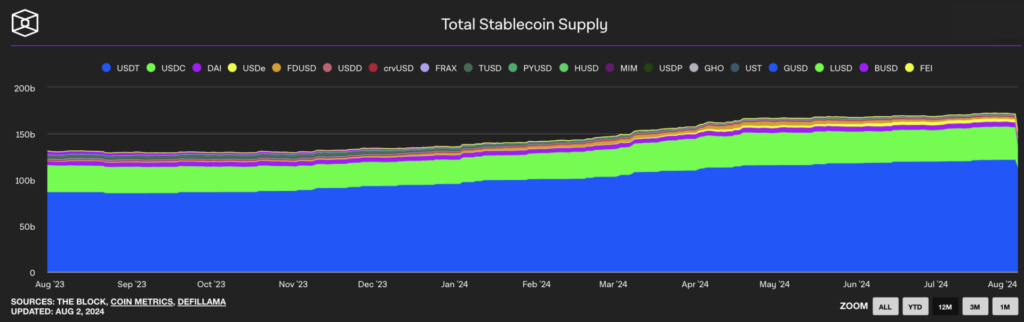

Stablecoin supply has reached levels last seen in 2022 before the infamous Terra UST collapse.

Stablecoin Adoption

Stablecoins have undeniably captured the world’s attention. With a market capitalization now soaring to $164 billion, this burgeoning asset class has experienced a remarkable resurgence since the catastrophic Terra collapse in May 2022. In fact, stablecoins have showcased consistent growth over the past ten months, commanding an impressive 6.93% market dominance. To underscore this explosive growth, consider the staggering $44.71 billion in stablecoin volume generated within just two trading days in June 2023 – representing over 60% of the entire crypto market’s trading activity over that period.

On one hand, the rise in stablecoin supply highlights the crucial role they play in solving the inefficiencies of sending value across borders as well as preserving wealth in markets plagued with uncertainty. Many African investors and businesses leverage stablecoins for real-world payments and cross-border remittances, taking advantage of their stability as well as their ability to move instantaneously and with little friction.

On the other hand, stablecoins play a crucial role in fuelling activity within the rapidly expanding Decentralised Finance (DeFi) ecosystem. They offer crypto traders seamless entry and exit points, enabling them to secure profits while retaining market exposure. Beyond this, stablecoins are essential to DeFi operations, serving as collateral in lending protocols like Aave and providing liquidity on decentralised exchanges (DEXes) like Uniswap. This functionality not only generates attractive yields for investors but also enhances overall market efficiency. Their pivotal role in both lending and liquidity underscores stablecoins’ versatility and their integral contribution to the growth and success of the broader cryptocurrency landscape.

Major Market Players

Stablecoin access is becoming increasingly fluid as centralized exchanges like OVEX streamline the process of entering and exiting the stablecoin ecosystem. Clients can purchase stablecoins with their local currency and either hold them or off-ramp into other fiat currencies. As OVEX and similar exchanges expand their funding options, investors can capitalize on cross-market functionality more effectively. Compared to the fragmented, slow, and cumbersome traditional banking system, stablecoins offer unparalleled speed and efficiency, making transactions almost instantaneous and significantly reducing friction. This advantage highlights the growing appeal of stablecoins in facilitating seamless global financial operations – a growing use case in broader Africa.

The two leading stablecoins, Tether (USDT) and Circle’s USDC, dominate the market with distinct growth trajectories. Tether remains the largest, reaching a record market cap of $114.45 billion as of August 01, and holding a commanding 69.3% share of the market for stablecoins. In contrast, Circle’s USDC has also demonstrated significant growth, with its market capitalization peaking at $33.2 billion on August 01, following six consecutive months of supply increases. This expansion aligns with a surge in demand for USDC in crypto trading, highlighted by its all-time high monthly trading volume in March. USDC’s adoption has been further supported by increased on-chain activity on networks such as Base and Solana, with its supply on these chains rising to 9.29% and 7.78% respectively.

Tether’s record-breaking profit of $5.2 billion in the first half of this year exemplifies the lucrative opportunities available to stablecoin issuers through strategic investments in low-risk asset classes like U.S. Treasuries. With a market capitalization of approximately $114 billion and reserves surpassing $118 billion, Tether’s U.S. Treasury holdings are larger than those of all but 17 of the world’s governments, including Germany, the United Arab Emirates, and Australia. Additionally, Tether ranks third in the purchase of three-month U.S. Treasuries, behind only the United Kingdom and the Cayman Islands. Tether’s massive holdings of U.S. Treasuries allow it to benefit significantly from even small increases in interest rates.

The Future For Stablecoins

As the cryptocurrency ecosystem continues to mature, the versatility and resilience of stablecoins will likely play an increasingly vital role in bridging the gap between digital and traditional finance. The advancements in stablecoin technology and infrastructure, alongside their growing acceptance and utilization, hint at a future where these digital assets could redefine the landscape of global finance. For investors, businesses, and financial institutions alike, understanding and leveraging the potential of stablecoins will be crucial in navigating the complexities of the modern financial world. As we look ahead, one can only ponder the transformative impact that stablecoins might have on the future of finance and the broader global economy.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).