In early 2014 the world’s largest cryptocurrency exchange – responsible for 70% of global Bitcoin transactions – collapsed in stunning fashion. The Tokyo-based exchange, Mt. Gox, fell victim to the first ever major crypto exchange hack – resulting in a whopping 940,000 BTC drained unbeknownst to the exchange’s 24,000 users. Thankfully well-known cryptocurrency exchanges in today’s day and age have learnt from the errors of their predecessors and news of this nature is now incredibly rare if not impossible.

Fast-forward to today and Mt. Gox liquidators have managed to recover 15% of the stolen Bitcoin.

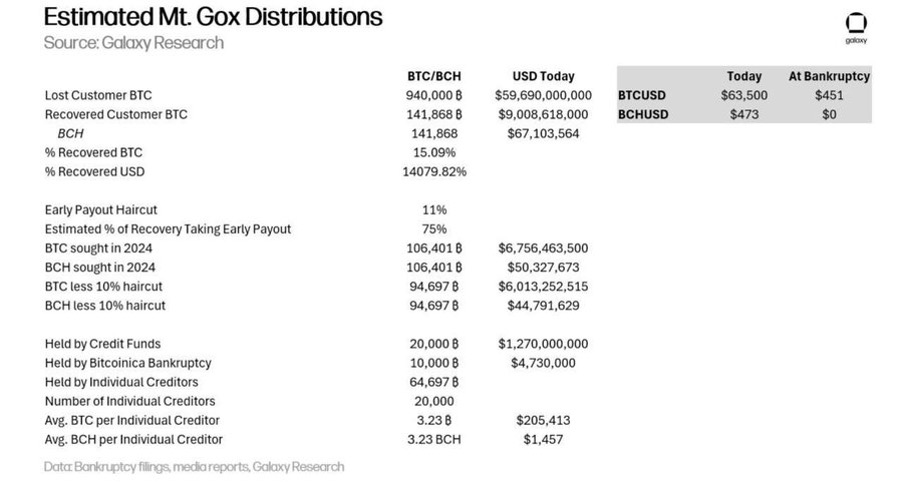

Here is a summary of where Mt. Gox liquidators find themselves today:

- 940,000 BTC lost

- 15% were recovered, totalling 141,868 BTC

- BTC price at the time of bankruptcy: ~$451

- Bitcoin price today: ~$60,000

The estimated distribution can be seen in the below Galaxy Research breakdown:

This implies that if a creditor held 10 Bitcoin on the Mt. Gox exchange at the time of its bankruptcy, they would only be able to recover 1.5 Bitcoin today. Back then, this 1.5 Bitcoin was valued at a meager $676. However, the scenario has dramatically changed – today the same 1.5 Bitcoin is worth an astounding $90,000.

This represents a staggering increase of over 13,000%, sparking concerns among many that creditors might opt to liquidate their Bitcoin holdings immediately following the repayment to capitalize on the significant profit.

However, analysts believe this panic is overstated. In reality – these creditors have a low cost basis on the recovered Bitcoin and as a result may feel less inclined to sell. Not to mention the fact they risk incurring massive capital gains tax if they were to realise these astonishing gains.

Additionally; of the 141,868 BTC recovered, approximately 20,000 coins are owed to claims funds and about 10,000 coins are owed to Bitcoinica BK. Then there is the 75% of Mt. Gox users who opted to take a 10% haircut on their repayment to receive early distribution. This only leaves around 65,000 BTC available to individual creditors. So in reality around 65,000 BTC of the total 141,868 BTC may actually hit the market.

Then there is the fact that these individual creditors are likely to be Bitcoin proponents given they were some of the earliest adopters. The proof may be in the pudding as these same creditors have resisted years of “compelling and aggressive offers” from claims offering payouts in US dollars, suggesting a preference for Bitcoin over fiat currency.

The Bitcoin repayments have been scheduled for July – so only time will tell what the actual impact of this news is.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).