Understanding Perpetual Futures in Cryptocurrency

| In this article, we’ll delve into the origins and mechanics of perpetual futures, exploring how they revolutionized crypto trading by offering a seamless blend of speculative opportunity and risk mitigation. Whether you’re a seasoned trader or new to the world of derivatives, understanding perpetual futures is essential to navigating the dynamic landscape of cryptocurrency markets.

Traditional Futures Contracts

A Foundation of Risk Management and Speculation

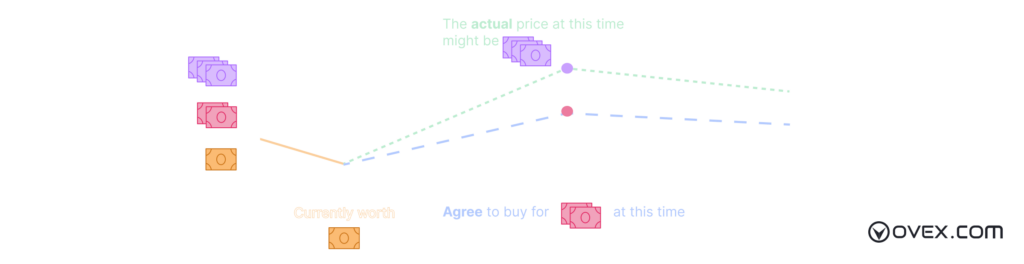

Traditional futures contracts are agreements between two parties to buy or sell an asset at a specified price on a set future date. These contracts derive their value from an underlying asset (like commodities, currencies, or stocks) and serve multiple purposes:

– Hedging: Protect against adverse price movements by locking in a future price.

– Speculation: Profit from price changes without owning the underlying asset.

For example:

– A buyer of a futures contract profits if the asset’s price increases above the agreed price.

– A seller profits if the asset’s price decreases below the agreed price.

This dual functionality has made futures contracts essential in financial markets.

Why Were Futures Contracts Created?

A Lesson in Hedging

Futures contracts originated to protect against price volatility, especially in agricultural and commodity markets. They enabled businesses to stabilize their income or costs regardless of bumpy market fluctuations.

Example: Corn Farmer & Corn Canner

The farmer locks in a selling price, fearing a price drop by harvest time.

The canner locks in a buying price, fearing a price increase.

Let’s say in July, corn trades at $3 per bushel, and both agree to that price for December delivery.

By December, the price falls to $2.50 per bushel:

The farmer sells corn at $2.50 in the market but earns back the $0.50 loss through his futures contract.

The canner buys corn cheaper at $2.50 but loses $0.50 on his futures contract.

Result: Both parties are shielded from price volatility, effectively locking in a stable price of $3 per bushel.

The Evolution of Futures

From Hedging to Speculation

While originally used for hedging risks, futures contracts evolved into powerful tools for speculation, appealing to traders looking to profit from market price movements without holding the actual asset.

Modern financial markets now offer futures contracts on:

– Commodities like oil and gold.

– Currencies like the U.S. dollar.

– Indices, stocks, and even cryptocurrencies.

Most contracts are cash-settled, meaning traders exchange the monetary difference instead of physically delivering the asset.

With the advent of cryptocurrencies, a new type of futures contract emerged: Perpetual Futures Contracts. These contracts revolutionized futures trading by eliminating expiration dates and introducing a mechanism to keep prices aligned with the market.

Perpetual Futures Contracts

A New Era of Derivatives

Perpetual futures, or Perps, differ from traditional futures in two major ways:

1. No Expiration Date:

Unlike traditional contracts, Perps can be held indefinitely, allowing traders to keep positions open for as long as they want.

They are settled entirely in cash (no delivery), making them ideal for speculative trading.

2. The Funding Rate Mechanism:

To keep the Perp price aligned with the spot price (market price of the asset), a system of regular payments between traders is used.

This structure makes Perps a pure speculative tool in cryptocurrency markets, where traders can bet on price movements without worrying about contract expiration.

The Funding Rate Mechanism

Keeping Prices Aligned

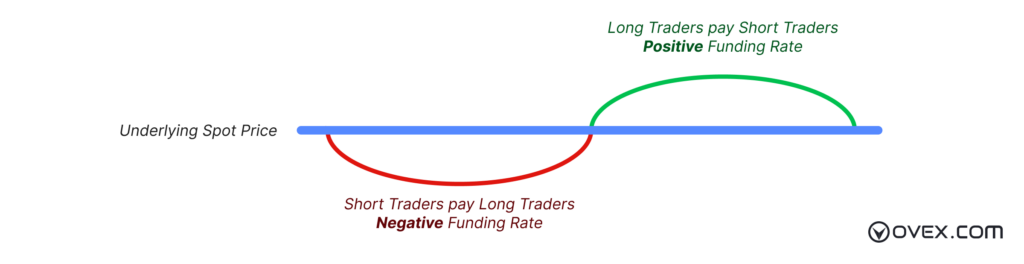

The funding rate mechanism is the engine that keeps perpetual futures prices tethered to the spot price of the underlying asset. Here’s how it works:

At regular intervals, the Perp price is compared to the spot price.

If Perp Price > Spot Price: The funding rate is positive.

This means traders holding long positions pay a fee to traders holding short positions, discouraging excessive buying.

If Perp Price < Spot Price: The funding rate is negative.

This means traders holding short positions pay a fee to long traders, discouraging excessive selling.

This ensures that:

1. When the Perp price rises above the spot price, traders are incentivized to sell or short.

2. When the Perp price falls below the spot price, traders are incentivized to buy or go long.

The Funding Rate Mechanism

Why Does This Mechanism Ensure Price Convergence?

The Funding Rate creates a dynamic cost or reward for holding a position:

1. Traders React to Costs: The side that incurs costs (paying the funding rate) is financially motivated to adjust their positions to reduce their exposure.

2. Arbitrage Opportunity: Institutional traders and market makers often exploit price differences between the Perp and Spot markets. By taking opposite positions in both markets, they profit from the funding payments, naturally driving Perp and Spot prices to converge.

How Perpetual Futures Work

Key Mechanics and Risks

Trading perpetual futures requires understanding their unique structure:

1. Initial Margin:

To open a position, traders provide a fraction of the contract’s value, leveraging smaller capital for larger exposure.

2. Maintenance Margin:

A minimum balance must be maintained to keep positions open. Falling below this triggers a margin call, potentially leading to liquidation.

3. Funding Rates:

Periodic payments between long and short traders ensure the Perp price stays aligned with the spot price.

4. Leverage and Liquidation:

High leverage amplifies both gains and losses. If the market moves significantly against a trader, their position may be liquidated to cover losses.

5. Longs vs. Shorts:

– Long positions: Bet that the price will rise.

– Short positions: Bet that the price will fall.

Risk Note:

Perps are inherently riskier than traditional futures due to their reliance on leverage and the volatility of cryptocurrency markets. Careful risk management is essential for traders.

Why Perpetual Futures Matter

What makes Perps so Transformative?

Perpetual futures contracts have transformed the financial landscape by providing:

– A flexible trading tool for speculating on price movements.

– Access to leverage, allowing traders to amplify potential returns.

– A highly liquid market, as these contracts attract both retail and institutional traders.

However, their speculative nature and the risks of leverage make them better suited for experienced traders with a solid understanding of market mechanics.

Takeaway: Perpetual futures are a groundbreaking innovation that enable traders to take on leverage without the need of rolling over positions. They are also a mechanism employed to hedge risk. Perps balance market speculation with a mechanism to maintain price stability, offering traders a versatile way to engage in crypto derivatives.