Turbulence Unleashed: A Period of Intense Volatility

Financial markets have undergone a sharp reversal, upending the consensus trades that dominated until early February. Both crypto and traditional markets are experiencing their most severe cross-asset losses since the Federal Reserve’s aggressive monetary-tightening campaign peaked in 2023.

In the equity markets, tech stocks suffered their steepest decline since 2022. The Nasdaq 100 Index plunged nearly 4%, erasing more than $1 trillion in market value. Leading this sell-off were the “Magnificent Seven” — the elite group of mega-cap tech companies that had previously fueled the bull market — as investors shifted toward perceived safer assets amid growing uncertainty.

The turbulence extended beyond equities. Cryptocurrency prices declined sharply, corporate bond sales were abandoned, and risk indicators surged. Wall Street’s VIX spiked, while some key measure of credit risk also rose significantly. At the same time, U.S. Treasuries rallied, driving yields lower as investors sought the safety of government bonds.

Many economists still maintain that the US will avoid the widely accepted definition of a recession—two consecutive quarters of shrinking output—but warn that the latest figures show the risks are mounting.

Market Volatility:

Bitcoin has not been spared from the broader market upheaval. The flagship cryptocurrency dropped more than 6% to its lowest level since November 2024, weighed down by fears of potential U.S. tariffs and following a fallout from a $1.5 billion exchange hack targeting Ethereum on Bybit.

In more recent weeks, Bitcoin has mirrored the volatility in equity markets, oscillating as investors attempt to digest President Donald Trump’s negotiation tactics on tariffs. Bitcoin finished the second week of March hovering around the $80,000 mark—a significant retreat from the $109,000 peak it reached on Inauguration Day just over 9 weeks ago.

US Market Recap

U.S. markets are grappling with heightened volatility as shifting policies and weak economic data weigh on investor sentiment. Tariff wars, unconventional policymaking, and uncertainty surrounding Federal Reserve decisions have all fuelled concerns about long-term economic stability.

Some analysts point to method in Trump’s seemingly brash approach. The U.S. faces $7 trillion in debt maturing within six months, forcing either repayment or refinancing. The Trump administration is reluctant to refinance at rates exceeding 4%, especially with the U.S. 10-year Treasury yield reaching 4.8% earlier this year. To lower these costs, some analysts believe Trump is deliberately inducing economic uncertainty through tariffs. This strategy could unsettle equity markets, driving investors toward bonds and pushing yields down. The resulting economic slowdown would then provide justification for Federal Reserve interest rate cuts, further reducing yields and enabling cheaper refinancing.

February 25: Confidence in American exceptionalism appears to be waning, as U.S. equity markets decline, bond yields fall on growth concerns, and the dollar weakens.

February 28: The Department of Government Efficiency (DOGE) announces 62,242 federal job cuts across 17 agencies.

March 04: President Donald Trump’s 25% tariffs on imports from Canada and Mexico take effect, though Canadian energy imports face a reduced 10% tariff. Additionally, tariffs on Chinese imports are doubled to 20%.

March 05: U.S. markets face a growth scare due to heightened policy uncertainty. The unpredictable nature of tariff decisions, combined with concerns over public sector layoffs – fuelled investor anxiety – leading to a sell off across risk-on assets.

March 06: Volatility in U.S. policymaking threatens to erode one of America’s key economic advantages—long-term investor confidence in its policy framework and decision-making stability. This echoed into the uncertainty regarding continuity upended by Trump negotiations on tariffs – which have shifted from aggressive positions to partial rollbacks, leaving markets uncertain. This unpredictability is compounded by ambiguity surrounding future Federal Reserve rate decisions, as policymakers attempt to balance weak economic data with persistently high inflation.

March 06: On the eve of the first-ever White House crypto summit, President Trump issues an executive order establishing a Bitcoin strategic reserve. The reserve will be stocked with Bitcoin seized through civil and criminal forfeiture rather than purchased outright. The market reaction is subdued, as traders had hoped the reserve would be built through a combination of forfeitures and a government purchasing program. The absence of direct government buying underwhelmed market participants looking for a stronger bullish signal.

March 10: The February U.S. jobs report reveals the addition of 151,000 jobs—falling short of the expected 170,000. The unemployment rate ticks up to 4.1%, exacerbated by federal layoffs and hiring freezes. Markets react sharply, with fears of stagflation taking hold. The S&P 500 falls 2.7% to 5,614.56, the Nasdaq Composite plunges 4% to 17,468.32—its worst session since September 2022—and the Dow Jones Industrial Average drops 890 points, closing at 41,911.71.

Rest of World Market Recap

Rest of World Markets have been struggling with three areas of uncertainty globally: tariffs, geopolitics and U.S. fiscal policy.

With U.S. military support for Europe possibly on the decline, governments across the continent are pledging budget-busting increases in defense spending. Germany, for instance, this week saw one of its worst bond crashes ever, with the 10-year Bund yield jumping more than 40 basis points to the current 2.83%. This provided European risk-on assets with much needed relief.

March 04: China announces additional retaliatory tariffs to take effect on March 10. The retaliation would tariff $2.9 billion of U.S. agriculture exports at 15 percent and another $16.6 billion of U.S. agriculture exports at 10 percent.

March 05: Yields on German government bonds — known as bunds — skyrocketed, with the yield on the 10-year debt instruments adding around 40 basis points. The sell-off came after lawmakers from parties widely expected to form Germany’s next coalition government agreed to plans to reform historic debt policy rules to allow an increase in national defense spending. Germany’s plans and increased European defense spending are estimated by BNP Paribas to increase potential GDP growth by 1.5% in Germany and 0.8% in the eurozone by 2030. Meanwhile, Commerzbank suggests these measures could easily add up to more than 1 trillion euros of additional debt over the next 10 years, significantly boosting the supply of top-rated bonds sought after by investors globally.

March 06: The European Central Bank lowered interest rates for the sixth time since June and indicated that its cutting phase may be drawing to a close as inflation cools and the economy digests seismic shifts in geopolitics. Lagarde notably referred to the uncertainty facing global markets with a changing geopolitical and trade environment in the Trump Era. The ECB lowered its 2025 economic growth forecast for the fourth consecutive time, putting expansion this year at just 0.9%, only slightly above the 0.7% pace recorded in 2024.

March 07: Despite U.S. tariff threats and concerns over declining military support, European stock markets have outperformed their U.S. counterparts this year—particularly the DAX index, which tracks Germany’s blue-chip companies—and the euro has picked up against the dollar.

March 10: Consumer prices in China plunge to their lowest level in more than a year, highlighting persistent deflationary pressures in the world’s second-largest economy. This follows the release of CPI and PPI numbers. China’s economy continues to be weighed down by weak consumer spending, an uncertain employment outlook, and a prolonged property sector downturn. Internationally, it also faces increasing pressure as the United States escalates its trade war tactics, further straining China’s export-driven growth.

Volatility is Back

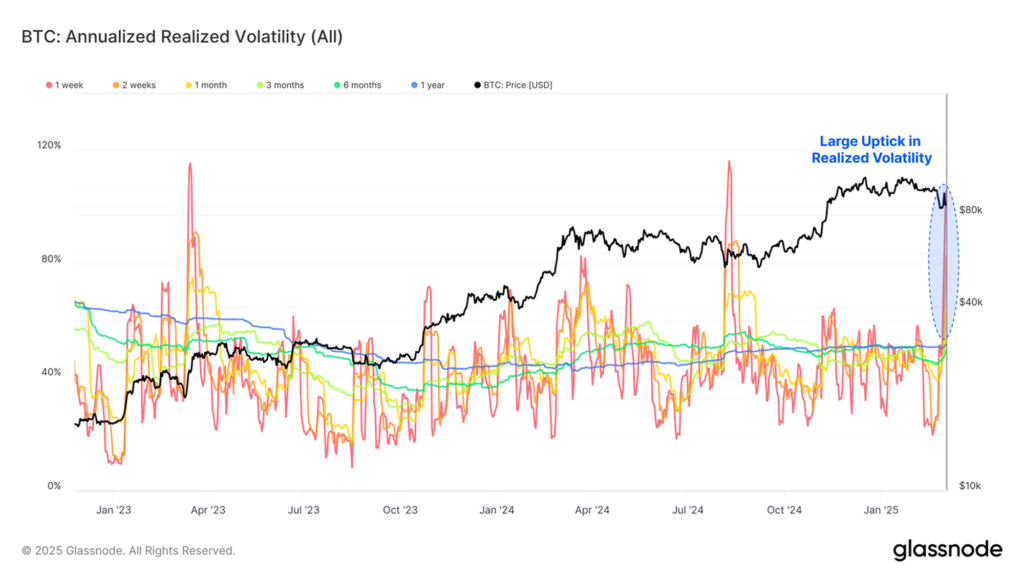

Annual Realized Volatility for Bitcoin

March has ushered in a period of intense volatility for Bitcoin, a stark contrast to the steadier gains seen earlier in the year. The raw numbers tell the story: swings of 23% and 16% in consecutive weeks, with Bitcoin’s price bouncing between the $78,000 and $96,000 range. This whipsawing action signals a significant shift in market dynamics, driven by a surge in sell-side pressure.

Examining realized volatility confirms this trend. Both the 1-week and 2-week rolling volatility metrics have spiked, reaching levels above 80% – some of the highest seen in this market cycle. This heightened volatility reflects not only the magnitude of price swings but also the increasing uncertainty gripping the market.

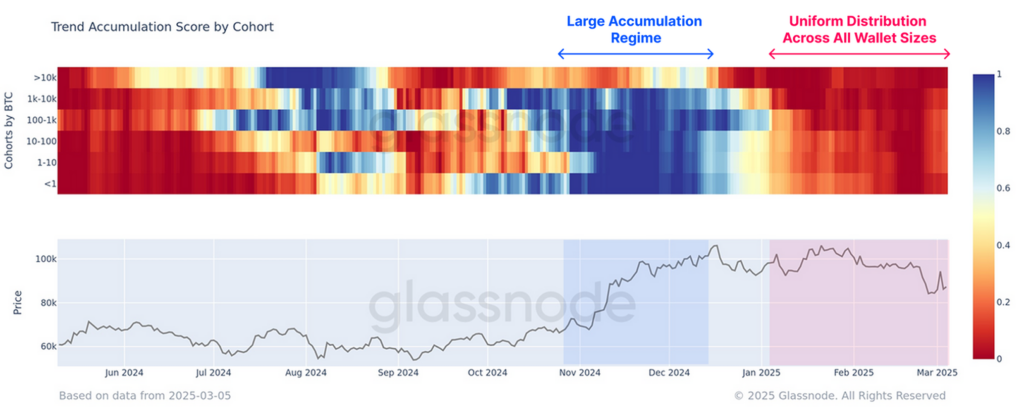

On-chain data reveals a notable trend: widespread distribution across all wallet sizes. Regardless of holding size, investors have been selling off Bitcoin over the past two months, with the intensity of this selling pressure accelerating since mid-January. This uniform distribution suggests a broader shift in sentiment, potentially driven by a combination of factors, including the increasingly uncertain economic environment and the swirling speculation that surrounded the US Strategic Digital Asset Reserve.

Trend Accumulation Heatmap

Breakdown of Conviction:

Large wallet holders, or “whales,” are typically seen as having the strongest conviction in Bitcoin’s long-term potential. When they begin to distribute their holdings, it signals a breakdown in that conviction. This can create a cascading effect, as smaller investors interpret the actions of whales as a sign of impending decline, leading them to sell as well.

Looking Ahead:

The sustained distribution across all wallet sizes suggests that this period of volatility may persist. Monitoring on-chain data for signs of accumulation, particularly from larger holders, will be crucial in gauging potential shifts in market direction. Additionally, the evolution of the US Strategic Digital Asset Reserve narrative and broader economic indicators will continue to play a significant role in shaping Bitcoin’s price action.

Paper Hands:

A significant proportion of this sell-side has originated from coins which are locking in a loss. The Realized Loss across all market participants hit $818M/day this week, with only the yen-carry-trade unwind on 5-Aug-2024 recording a larger value ($1.34B). This showcases that the current market downturn has been a challenging environment for investors, with many exiting the market below their cost basis under the pressure of the drawdown.

Yen Carry Trade Unwind:

Some speculate that the recent price action may be, at least in part, a result of the yen carry trade unwind.

This theory suggests that leveraged positions in Bitcoin, funded by yen, are being liquidated due to shifts in the global macroeconomic landscape.

It may be a coincidence, but the recent decline in the Nasdaq and Bitcoin (BTC) coincides with a sharp rise in Japanese government bond yields and the strengthening of the safe-haven Japanese yen (JPY), reminiscent of the market dynamics seen in early August.

There could be a causation here, as, for decades, the low-yielding yen propped up global asset prices. The ongoing rise in the Japanese yen may have had a hand in the recent risk aversion on Wall Street and in the crypto market.

Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).