In recent years, it has become increasingly fashionable for the political chattering class to look beyond traditional polls and turn to prediction markets to gauge electoral sentiment. While betting is not an exact science and ‘the crowd’ is not infallible, prediction markets do offer a dynamic way to anticipate election outcomes. Their accuracy is becoming increasingly prevalent as more and more people participate in these markets, thereby creating a larger sample of bettors. Much like how sports betting markets have evolved to reflect population sentiment with near-perfect odds, political prediction markets are inching toward similar levels of precision.

Let’s explore why prediction markets are often considered superior to polls when forecasting election results:

1. Speed and Forward-Looking Nature

Prediction markets provide information far quicker than traditional polls, pundits, or media outlets. Unlike polls, which offer a retrospective snapshot of the electorate’s opinon, prediction markets are inherently forward-looking. Investors in these markets don’t just reflect on past opinions; they anticipate the outcome of the election and place their bets accordingly. Just as the stock market serves as a leading indicator for the economy, prediction markets act as leading indicators for elections, reflecting real-time shifts in public sentiment.

2. Real-Time Information

One of the key advantages of prediction markets is their ability to respond instantly to public events. If a candidate gives a standout speech, fares well in a debate, or experiences a media surge, prediction market prices adjust swiftly. Conversely, if a candidate makes a major gaffe or faces a damaging scandal, the market reacts just as quickly – pricing in these real-time developments instantaneously. This responsiveness allows prediction markets to provide more up-to-date reflections of electoral sentiment when compared to static polling data.

3. Bias Reduction Through Financial Stakes

In prediction markets, participants have a financial stake in the outcome, which significantly reduces the influence of personal bias. Polls typically ask people who they want to win, while prediction markets ask participants who they think will win. The introduction of real money encourages individuals to put aside their personal preferences and think logically about the most likely outcome. As a result, prediction markets are often seen as more reliable indicators, with financial incentives driving rationality over emotional or partisan inclinations.

4. Participation by Informed Traders

The economic incentives behind prediction markets attract informed participants who, in turn, share their insights with the broader market in pursuit of financial gain. In essence, the market benefits from the knowledge of participants with access to insider information or deeper insights into electoral dynamics. This information-sharing process contributes to a more accurate representation of all available data, making prediction markets an increasingly accurate tool for forecasting election outcomes.

The Case of Polymarket: A Crypto-Driven Prediction Platform

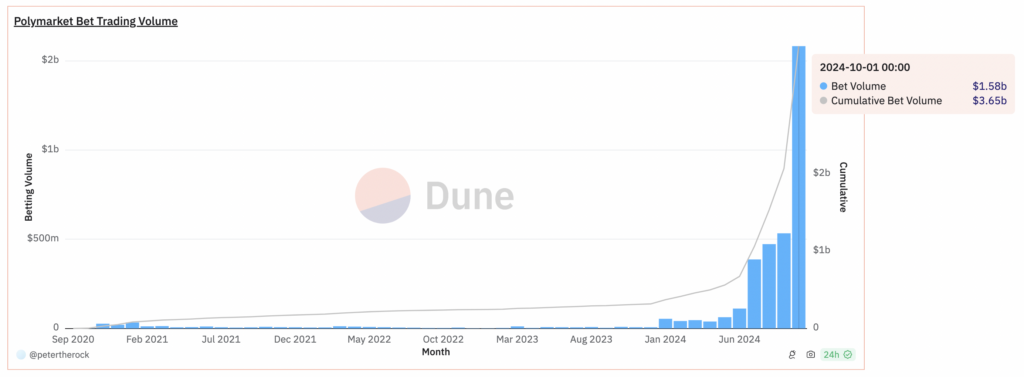

One standout example of the rise in prediction markets is Polymarket, a decentralized platform built on the Ethereum and Polygon blockchain networks. Launched in 2020, it offers a decentralized platform where both retail and institutional traders can place bets on various future events, including pop culture, economic indicators, weather patterns, awards, as well as political and legislative outcomes. All transactions and market outcomes are publicly recorded on the blockchain, making the system transparent and a more accurate real-time source of public sentiment. Market participants can verify outcomes and trades, which fosters confidence in the system. Polymarket has seen its demand soar during the 2024 election cycle. The prediction market has registered over $3.65 billion in betting volume since its inception, with over $2 billion in 2024 alone (as a result of election bets).

Polymarket has even outpaced traditional sources of electoral analysis in some cases. For instance, long before President Joe Biden’s troubled debate performance, Polymarket traders signaled significant odds that he might withdraw from the race—predictions that mainstream pundits largely dismissed until the debate took place.

The Limitations of Prediction Markets

However, prediction markets are not without their flaws. One notable issue is that they can mirror the biases inherent in the investment world. Participants in these markets tend to be disproportionately male and represent those with disposable income—groups that do not always reflect the wider electorate. In the world of cryptocurrency-based markets like Polymarket, these biases can be even more pronounced, with younger, risk-tolerant investors driving much of the market activity. In contrast, political polls are designed to capture a broad demographic cross-section, aiming for a more representative sample of the electorate.

Another challenge is regulatory restrictions. Polymarket, for example, is not available to US residents due to a settlement with the Commodity Futures Trading Commission in 2022. As a result, its markets primarily reflect the views of non-US participants, who, while informed, are not directly eligible to vote. Despite this, the publicly available information accessible to these foreign investors is often on par with that of US voters, allowing for educated bets on election outcomes.

Conclusion

As the 2024 US election draws closer, prediction markets like Polymarket offer an intriguing alternative to traditional political polling. With real-time responsiveness, forward-looking insights, and financial incentives that drive objectivity, prediction markets may provide a clearer lens through which to anticipate election results. While not without their limitations, such as demographic biases and regulatory hurdles, prediction markets are rapidly emerging as a more accurate and dynamic tool for election forecasting—potentially reshaping how we analyze and predict political outcomes in the future.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).