The cryptocurrency space has seen its fair share of milestone developments. Some predictable – like Bitcoin Halvings – others less so – like a pro crypto presidential candidate assassination attempt. That one was rough – but in retrospect the best outcome for the crytpo-economy possible.

This past month we crossed yet another historic milestone, this time not so predictable. The United States Securities and Exchange Commission (SEC) has, after considerable reluctance, given the green light to 9 Spot Ethereum ETF issuers. A watershed moment for the Decentralized Finance (DeFi) space and expanding access to as well as diversifying the crypto-economy.

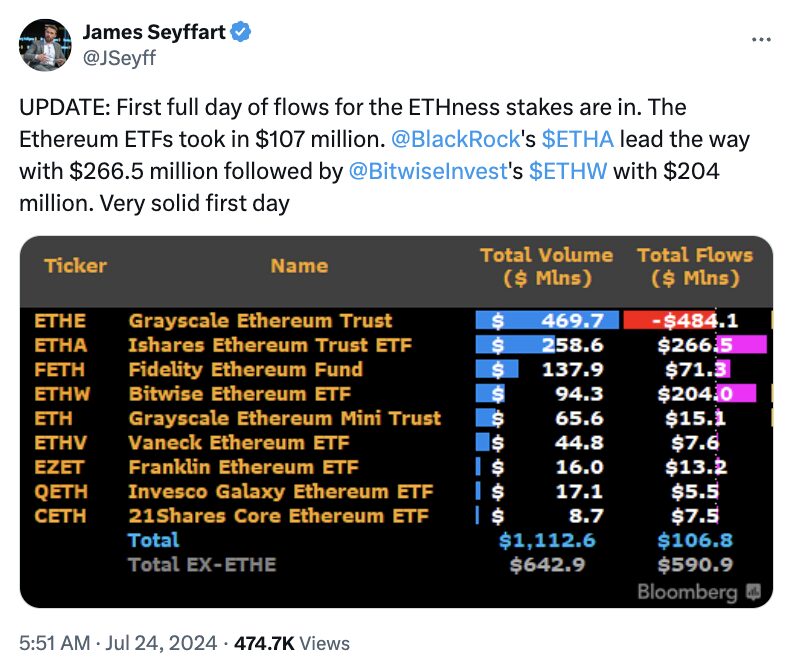

The debut was (more-than) impressive. These ETFs generated a staggering $1.08 billion in cumulative trading volume on their first day. BlackRock’s iShares Ethereum Trust (ETHA) and Bitwise’s Ethereum ETF (ETHW) emerged as leaders, attracting $266.5 million and $204 million in net inflows respectively. Fidelity’s offering, the Ethereum Fund (FETH), secured a strong third place with $71.3 million. Bloomberg senior ETF analyst Eric Balchunas highlighted the successful launch on social media, noting that the volume placed these ETFs among the top 1% of all ETF launches, comparable to established giants like TLT and EEM.

The only other available comparison would be the January debut of Spot Bitcoin ETFs, which saw $655.2 million in inflows on their first day of trading. The Ethereum ETF launch saw $107 million in net inflows, representing about 16% of the volume witnessed during the Bitcoin ETF launch. Despite this, several of the funds finished the day among the top 50 highest-traded US ETF debuts of all time.

All these issuers introduced Ethereum and its use case to their client base in a marketing push to sway the otherwise more traditional market players. Each issuer identified three key components to the Ethereum network:

- A highly programmable blockchain

- A platform for applications

- Tokenization, DeFi, and stablecoins

This goes to show that ETFs are more than just opening up access. They make it possible for large, reputable, and seasoned players to educate the masses about technological feats like Ethereum and how this network has diverse use cases beyond just JPEGs.

We are getting used to single coin ETFs for crypto, but soon we will see real ETF baskets, more diversified. The successful initial trading of these Ethereum ETFs reflects growing investor interest in digital assets and their integration into mainstream financial products. This development is expected to further boost crypto’s visibility and adoption in traditional markets.

The approval of these ETFs marks a significant step forward in the maturation of the cryptocurrency market. It signifies regulatory recognition and the growing acceptance of digital assets within traditional financial systems. For Ethereum, this means more than just increased liquidity and market depth; it is an acknowledgment of its utility and potential to revolutionize various sectors.

From programmable smart contracts to decentralized applications (dApps) and the burgeoning field of tokenization, Ethereum’s versatility is being showcased to a broader audience. This can lead to more innovative uses and a deeper understanding of blockchain technology’s potential.

Looking ahead, the successful launch of these Ethereum ETFs might set a precedent for future cryptocurrency-based financial products. The integration of digital assets into mainstream finance could pave the way for more sophisticated and diversified investment strategies, potentially including baskets of various cryptocurrencies and blockchain-related assets.

In conclusion, the launch of Spot Ethereum ETFs in the United States is a landmark event, heralding a new era of crypto integration into traditional finance. The strong initial trading volumes and substantial inflows reflect the growing appetite for digital assets and their potential to reshape the financial landscape. This development is not just about new investment opportunities but also about educating and familiarizing traditional market players with the transformative power of blockchain technology.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).