A scheme for assigning serial numbers to sats that turned into Bitcoin NFTs.

A manipulation (or rather use case) of the Bitcoin blockchain has evoked a major stir in the land of milk and honey (aka Bitcoin).

The recently launched project, pioneered by Bitcoin core dev: Casey Rodamor, is powered by the Ordinal protocol and has paved the way for the creation of Bitcoin NFTs (loosely known as ‘Ordinals’).

Ordinals leverage the existing infrastructure of the Bitcoin mainnet. This manipulation effectively enables the creation of Bitcoin-native on-chain NFTs.

The audacious project, however, has been met with both praise and criticism in the Bitcoin camp.

NFTers believe it gives Bitcoin purpose beyond ‘money’. Bitcoin purists on the other hands see it a a gross violation of the networks intended purpose — the separation of money and state.

These Bitcoin NFTs are powered by something referred to as ‘Ordinal theory’. A means of imbuing satoshis (the smallest denomination of a Bitcoin) with numismatic value and allowing them to be collected and subsequently traded as curios.

ORDINAL THEORY

To understand Bitcoin Ordinals it is best to start with the meaning of the term ‘ordinal’. The Collins dictionary defines ordinal as “denoting a certain position in a sequence of numbers”. You can basically think of ordinals as the numbers used to denote the position of a runner in a race.

Ordinal numbers are also used as serial designators for satoshis (sats). An ordinal number is assigned to each sat based on the order in which they are mined, and is subsequently preserved across transactions. This essentially gives any single satoshi ever to exist (and there are 2100 trillion of them) a unique identity.

But how to track and transfer these now ‘unique sats’? Introducing Ord. A wallet and explorer that allows tracking the location of specific satoshis and their ordinal numbers — assigned by the Ordinals protocol — as well viewing, creating, and transferring the Inscriptions imbued on each individual satoshi. Uhhm okay so…what are these ‘Inscriptions’.

INSCRIPTIONS

The new Ordinals protocol allows people who operate Bitcoin nodes to inscribe each ‘unique sat’ with data, creating something called an Ordinal. This grants node operators a means of minting NFTs directly onto the Bitcoin blockchain.

In this way an Inscription is essentially metadata stored on the Bitcoin mainnet. Unlike traditional Bitcoin transactions that use an OP_RETURN to add extra data to a transaction, the Ordinal approach stores the metadata (aka Inscription) within the transaction itself. It does this by making use of the 2021 SegWit update that allows for up to 4MB of witness data to be stored in a block.

The Ordinal number assigned to each sat is used to identify and link the Inscription to a specific sat. This allows the digital artifact (or NFT) to be transferred along with said sat in a transaction. How much you are willing to pay for said sat is purely a result of demand dynamics (the same reason someone is willing to pay exorbitantly for a Beeple).

Not all Ordinals have Inscriptions assigned to them, and it is up to node operators to create and attach Inscriptions to their sats as they see fit.

ORDINAL NFTs

The rise of Ordinals’ didn’t take long. Just weeks after the Ordinal Protocol went live, fascinating collections started to emerge met with equally fascinating demand. Some individual pieces sold for hundreds of thousands of dollars.

The first of these fascinating collections? Ordinal Punks. A collection of 100 generative punks that were minted within the first 650 Inscriptions on the Bitcoin blockchain. Just recently, Ordinal Punk #41 sold for 11.5 BTC, or $249,052.

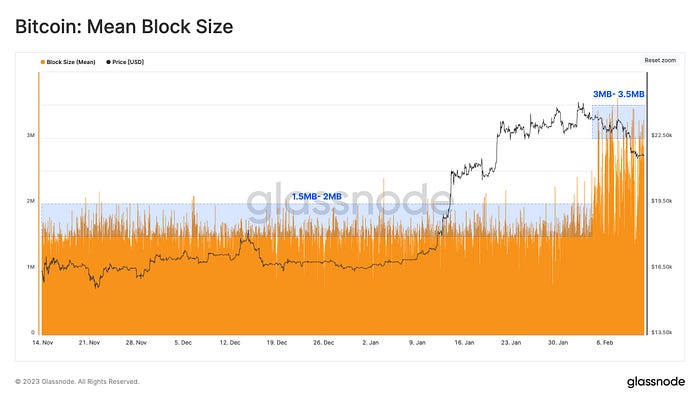

Second was Taproot Wizards. Beginning with Inscription #652, this project is an Ordinal collection of hand-drawn NFT wizards created by Web3 developer Udi Wertheimer. Udi’s collection has garnered much attention for successfully producing the largest block and transaction in Bitcoin history — coming in at a staggering 4MB.

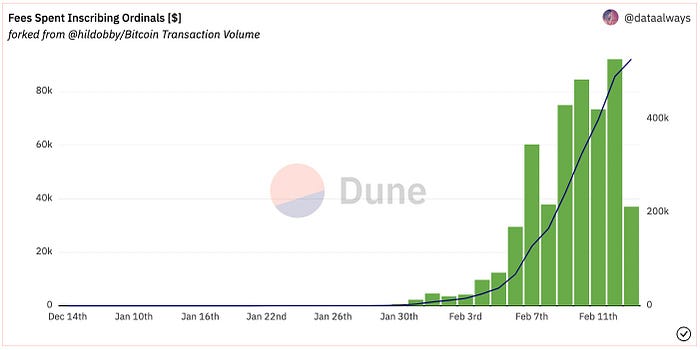

Since the the launch of Ordinals in mid-December 2022, users have inscribed nearly 74,000 NFTs onto the Bitcoin blockchain, earning miners a cumulative $574,000 in BTC transaction fees to date.

Bitcoin purists worry that Ordinals are spamming valuable block-space as well as congesting the network thereby forcing transaction fees to soar.

Since the introduction of Ordinals — Bitcoin’s mean block size has jumped from its typical average of 1.5–2 MB to between 3 and 3.5 MB in early February of 2023.

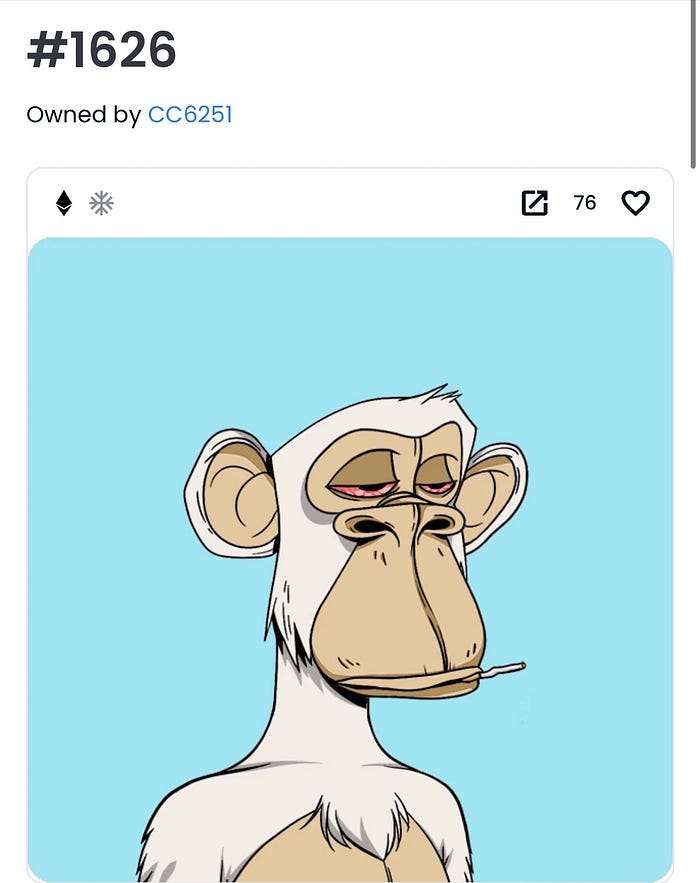

That is not stopping NFT enthusiasts from using Bitcoin however they see fit. Some diehards are showcasing their conviction by putting their money where their mouths are. The owner of BAYC #1626 burned his (Ethereum) NFT, to symbolically shift its existence to Bitcoin. How? Well because the location to which BAYC #1626 was burned to is linked to an Inscription made through Ordinals. BAYC #1626’s most recent change of hands was valued at $432,000 at the time of said transaction. But Yuga Labs insists it is an illegitimate Ape.

No need for a hard fork. The existing Bitcoin infrastructure seems to work just fine for the Ordinal clan. Only time will tell whether Ordinals are the next phase for NFTs or just an experiment waiting to die.