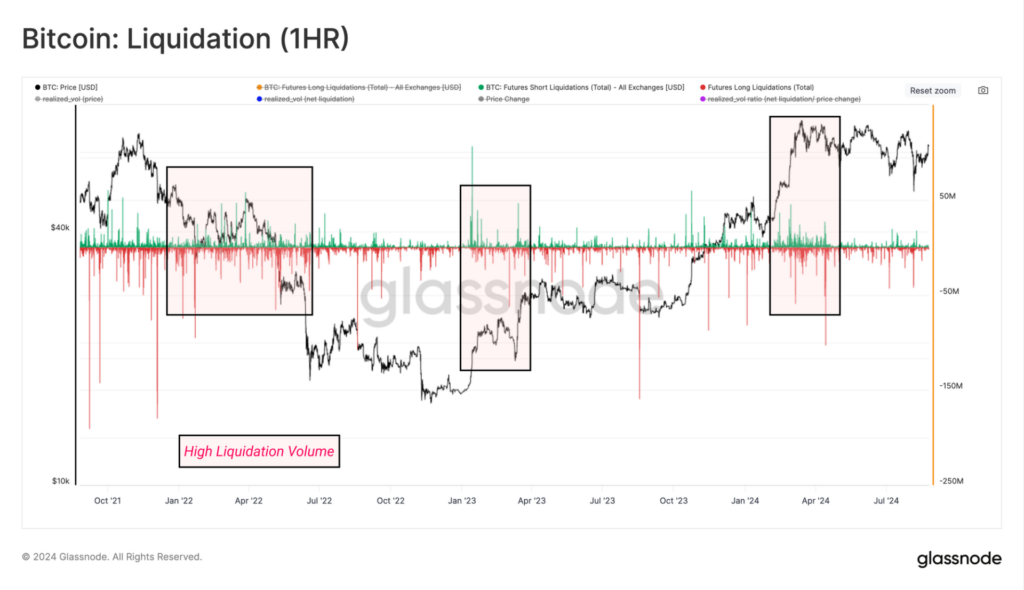

A recent report by on-chain analytics firm Glassnode highlights a significant shift in the Bitcoin market, where speculative interest seems to be waning, giving way to a more spot-dominated market regime. The report reveals that liquidation volumes in perpetual swap contracts have markedly declined, particularly since the market elation experienced in March when Bitcoin rallied to fresh all-time highs. This trend suggests that traders are increasingly cautious about leveraging positions, reflecting a broader decline in risk appetite.

A key finding in the Glassnode report is the strong correlation between monthly price volatility and net liquidation volumes in Bitcoin. As market volatility rises, leveraged positions are often squeezed, leading to amplified market movements. However, the current data shows a significant decrease in both volatility and liquidation activity, signaling that traders are currently less inclined to take on risk.

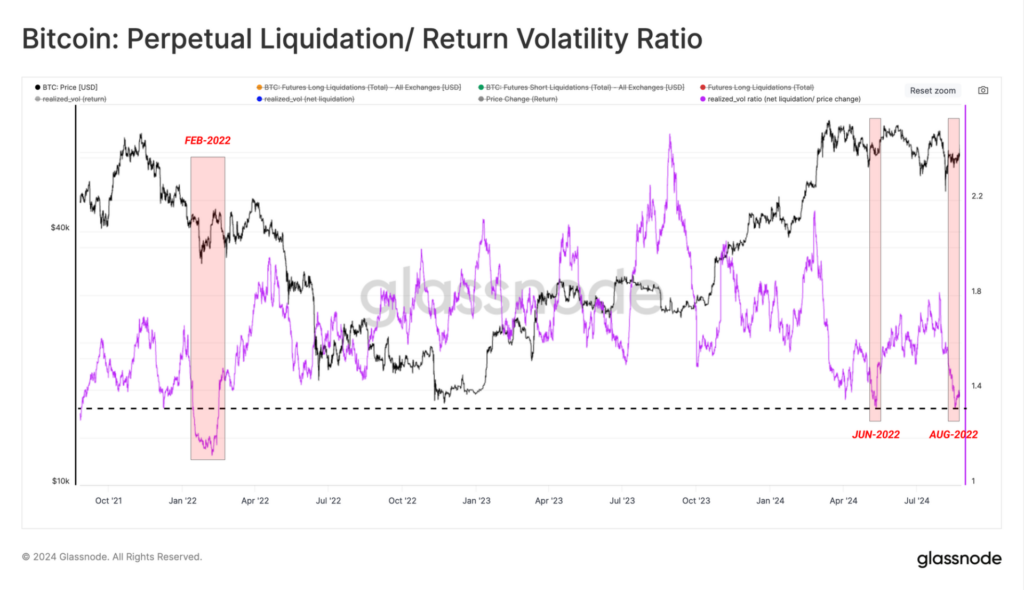

Interestingly, the ratio between price and net liquidation volume volatility is approaching levels last seen in February 2022. This indicates a substantial reduction in traders’ appetite for leveraged positions, pointing to a market that may be stabilizing after a period of heightened speculation.

Furthermore, the report notes a decline in profit and loss-taking activities, with perpetual funding rates returning to neutral levels. This shift reflects a broader decrease in speculative interest across the crypto market, not just in Bitcoin. The slower net capital inflows into Bitcoin further support this trend, indicating that investors are now balancing profits with realized losses, rather than chasing new highs.

Glassnode’s analysis reveals that net realized profit/loss in the Bitcoin market currently stands at over $15 million per day, a stark contrast to the $3.6 billion per day seen when the market reached its $73,000 ATH in March. This substantial drop underscores the cooling speculative interest and the possibility of a more stable, spot-driven market in the near future.

As the market resets, the decline in speculative interest could pave the way for a more sustainable growth trajectory for Bitcoin, with reduced volatility and a stronger focus on long-term value.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).