The launch of US Spot Bitcoin ETFs and greater regulatory clarity have unlocked compliant access for institutional investors. This influx of sophisticated capital is reshaping Bitcoin’s market structure, maturing its volatility profile and marking a fundamental shift in how capital interacts with the network.

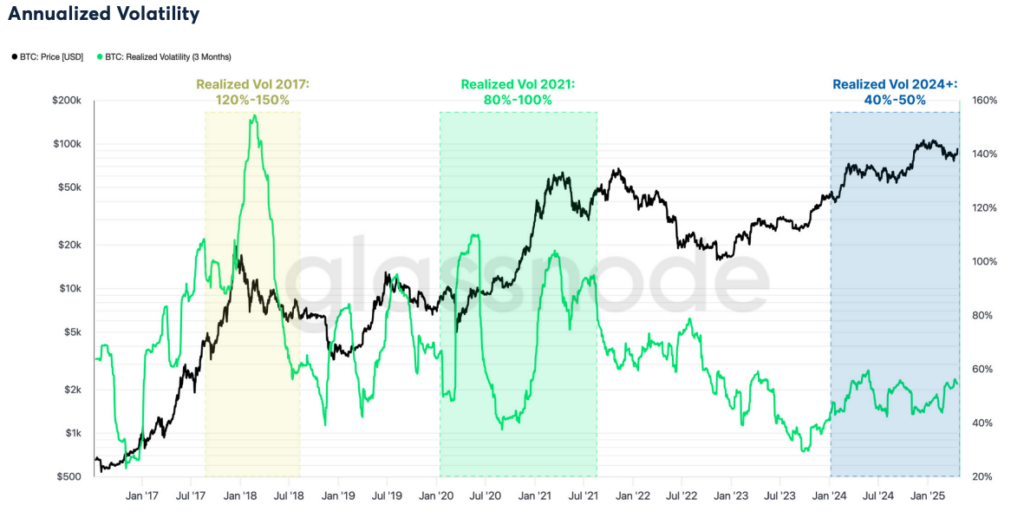

This changing dynamic is evident in realized volatility metrics. On a 3-month rolling window, realized volatility has remained under 50% for most of the current cycle — a sharp contrast to previous bull markets where volatility frequently exceeded 80% to 100%. This signals a more tempered and orderly rally, possibly due to institutional capital’s longer-term investment horizons and reduced sensitivity to short-term price swings.

In May, Bitcoin reached a new all-time high of $111.8k before retracing, as profit-taking by long-term holders began to pressure momentum. Key support levels at $103.7k and $95.6k are now being tested. This market phase is largely defined by seasoned investors — specifically those who accumulated during earlier uptrends — rotating capital as they lock in substantial gains. These intra-cycle long-term holders (LTHs) now dominate profit realization activity, a pattern that often coincides with top formation and signals increased risk of demand exhaustion.

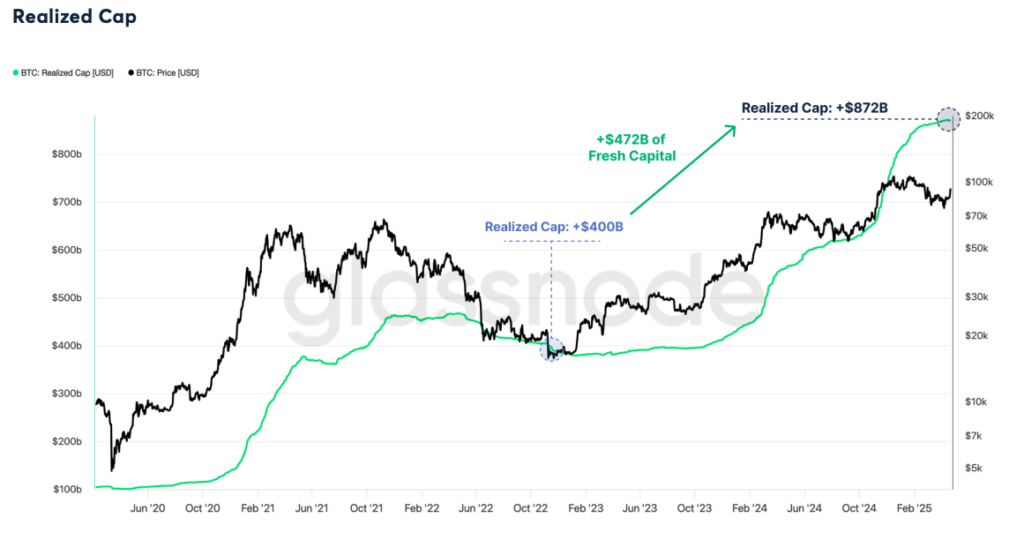

Cohorts holding for over 12 months have been the primary contributors to recent realized profits re-affirming the narrative of mature capital rotation. To gauge the broader value capture of the Bitcoin network during this cycle, one can look to Realized Cap — a metric that estimates the aggregate capital stored in Bitcoin by valuing each coin at the price it last moved on-chain. Since the cycle bottom in November 2022, Bitcoin’s Realized Cap has risen from $400B to $872B, indicating over $472B in net capital inflows. The key test ahead is whether this new layer of demand can successfully absorb the significant and sustained selling pressure from earlier cycle investors.

Futures markets also offer key insight. Perpetual swaps, the dominant derivative product in crypto, reflect short-term sentiment via funding rates. Since October 2023, funding rates have consistently shown a strong positive bias — reaching annualized levels of +50% as markets rallied to $73k in March 2024 — reflecting aggressive long positioning. However, during the May correction, these rates compressed sharply, indicating that traders are now de-risking and deleveraging.

Using the 7-day simple moving average of daily realized profits (excluding internal entity flows), realized profits peaked at $1.47B/day last week. This is the fifth time this cycle that realized profits have crossed the $1B/day threshold — levels typically associated with local tops or short-term corrections. Unless met with equal or greater inflows of fresh demand, this magnitude of profit-taking often signals vulnerability in price.

Bitcoin’s newfound market maturity now faces a classic cyclical test. The ability to absorb this significant wave of profit-taking from long-term holders may very well be the ultimate arbiter of the market’s near-term trajectory.