On January 3, 2009, Satoshi Nakamoto mined the Bitcoin Genesis Block, inscribing a powerful message into history: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This poignant reference to the 2008 financial crisis set the tone for Bitcoin’s mission: a decentralized alternative to traditional finance. Fifteen years later, Bitcoin has surpassed the $100,000 mark, transforming from a fringe experiment to a globally significant asset valued above silver, securing its place as the 7th most valuable asset in the world.

This milestone represents more than just a price achievement—it encapsulates Bitcoin’s remarkable journey from an obscure digital token to a transformative force in modern finance.

From Fractions of a Cent to Six Figures

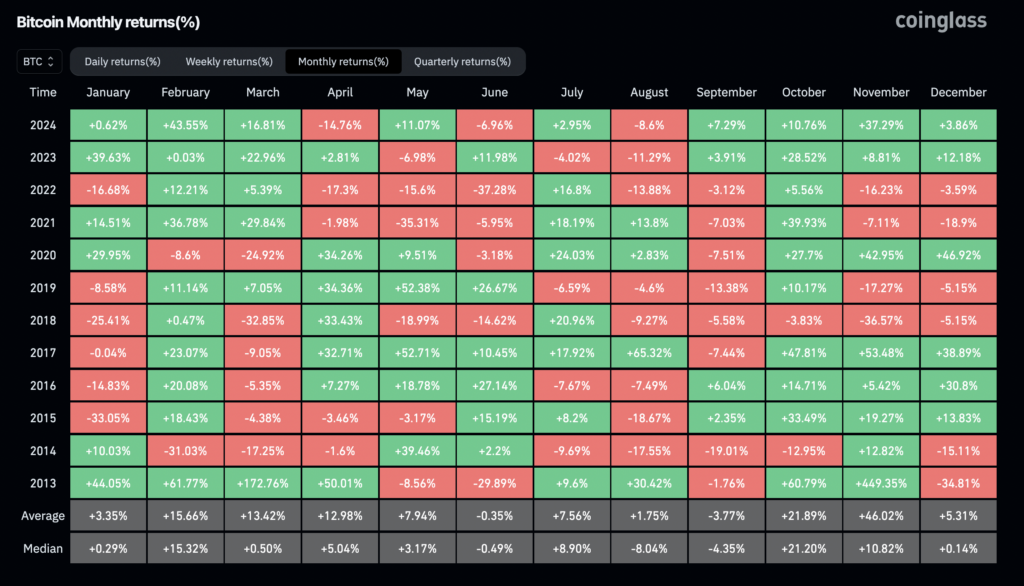

Bitcoin’s journey to $100,000 per coin is a story of resilience, innovation, and adoption. It has been actively traded for 5,256 days, navigating the cycles of bull and bear markets while fostering a loyal and expanding global user base. Over this period, Bitcoin has experienced 72 positive monthly candles, with an average gain of 37.4%, and 71 negative monthly candles, with an average decline of -14.2%. This balance underscores the volatility that has defined Bitcoin’s meteoric rise, yet also its positive skew during critical periods of appreciation.

With 19.8 million BTC mined to date, Bitcoin has processed 1.12 billion transactions and $131 trillion in transfer volume, cementing itself as one of the most efficient and trusted financial networks in existence. Its predictability, scarcity, and resilience in the face of regulatory pressure, geopolitical risk, and financial crises have made it a favorite among those seeking a hedge against uncertainty.

Bitcoin’s Positive Skew – Monthly Returns Since 2013

The Genesis Block: Where It All Began

Bitcoin’s Genesis Block, also known as Block 0, established the core parameters of the network. Notably, it contained 50 BTC that cannot be spent due to its unique structure—a symbolic reminder of Bitcoin’s roots.

The embedded message, referencing government bailouts of banks, highlighted the failures of centralized financial systems and introduced Bitcoin as a decentralized alternative. Nakamoto’s design included technical limitations that were later overcome with upgrades such as Segregated Witness (SegWit) in 2017, which enhanced scalability through reducing the size of each transaction’s data by separating certain data of the transaction signature from the transaction. Other upgrades include Taproot in Nov. 2021. This Bitcoin protocol upgrade prioritizes privacy, efficiency, and smart contract enhancements. Through the use of Schnorr signatures, Taproot has improved Bitcoin in terms of privacy.

Performance That Defies the Norm

Bitcoin’s cumulative growth since 2011 exceeds an astonishing 20,000,000%, far outpacing traditional asset classes. In comparison, the Nasdaq 100 Index grew by 541%, major US stock indices by 282%, and gold by a modest 1.5% over the same period. On an annualized basis, Bitcoin’s 230% return dwarfs all other assets, including high-yield bonds (5.4%), large US stocks (14%) and even gold (1.5%).

Investors have realized a net capital inflow of $750 billion, reflecting the delta between $1.27 trillion in on-chain profits and $592 billion in losses. This immense value creation underscores the network’s ability to attract capital and confidence over time.

Bitcoin Miners: The Backbone of the Network

Miners have played a critical role in Bitcoin’s success, earning $71.49 billion cumulatively. Of this, $67.31 billion came from block subsidies (newly minted BTC), and $4.18 billion from transaction fees. These rewards represent just 3.57% of Bitcoin’s peak $2 trillion market capitalization, an incredible return on the computational security budget that ensures the network’s integrity.

Bitcoin mining has also achieved staggering computational milestones. To date, miners have performed 5.01 x 10²⁸ hashes, with 37% of this computation occurring in 2024 alone, reflecting the rapid advancements in mining technology and network activity.

Institutional Adoption and Market Maturity

The approval of Bitcoin spot ETFs by the SEC in 2024 marked a turning point in institutional adoption. Firms like BlackRock, Fidelity, and Grayscale have introduced regulated products that attracted billions in cash inflows, legitimizing Bitcoin as a mainstream financial asset. These developments followed a tumultuous period, including the collapse of FTX in 2022, which temporarily drove Bitcoin’s price below $16,000. The resurgence in 2024 has highlighted Bitcoin’s resilience and the growing confidence in its role as digital gold.

Distribution of Supply

Bitcoin’s decentralized nature is reflected in its supply distribution:

- <0.001 BTC: 5,491 BTC (0.027%)

- 0.001–0.01 BTC: 42,683 BTC (0.216%)

- 0.01–0.1 BTC: 271,641 BTC (1.373%)

- 0.1–1 BTC: 1,077,839 BTC (5.446%)

- 1–10 BTC: 2,093,845 BTC (10.581%)

- 10–100 BTC: 4,306,780 BTC (21.761%)

- 100–1,000 BTC: 4,342,868 BTC (21.935%)

- 1,000–10,000 BTC: 4,693,216 BTC (23.716%)

- 10,000–100,000 BTC: 2,309,654 BTC (11.671%)

- >100,000 BTC: 647,934 BTC (3.274%)

Source: Glassnode

While smaller wallets reflect retail adoption, the majority of large wallets belong to institutions like exchanges, ETFs, and corporate entities such as MicroStrategy. These large wallets represent collective ownership, highlighting Bitcoin’s dual role as both a personal and institutional asset.

A Symbol of the Future

Bitcoin’s ascent to $100,000 is more than a financial milestone; it is a testament to the transformative potential of decentralized technology. Since its inception, Bitcoin has matured into a $2 trillion asset, surpassed silver in market value, and settled trillions in global transactions. Its scarcity, security, and trustless architecture have redefined what money can be in the digital age.

As Bitcoin continues to gain institutional adoption and navigate global challenges, it remains a symbol of the future of finance—one that is decentralized, transparent, and resilient. The journey to $100,000 is only the beginning. Bitcoin’s potential as a store of value and a medium of exchange on the world stage is more evident than ever.

DISCLAIMER: Dealing or trading in cryptocurrency carries risk. By dealing or trading in cryptocurrency you assume the inherent or associated risks arising from the volatility of cryptocurrency and its limited use in the mainstream marketplace, including loss of capital. Trading in cryptocurrency may not be suitable for all persons. Past returns or performance of any cryptocurrency are not a reliable indicator for future returns. This is not financial advice and is not an invitation to trade. Ovex (Pty) Ltd is an Authorised Financial Services Provider (FSP 53922) and a registered credit provider (NCRCP15552).